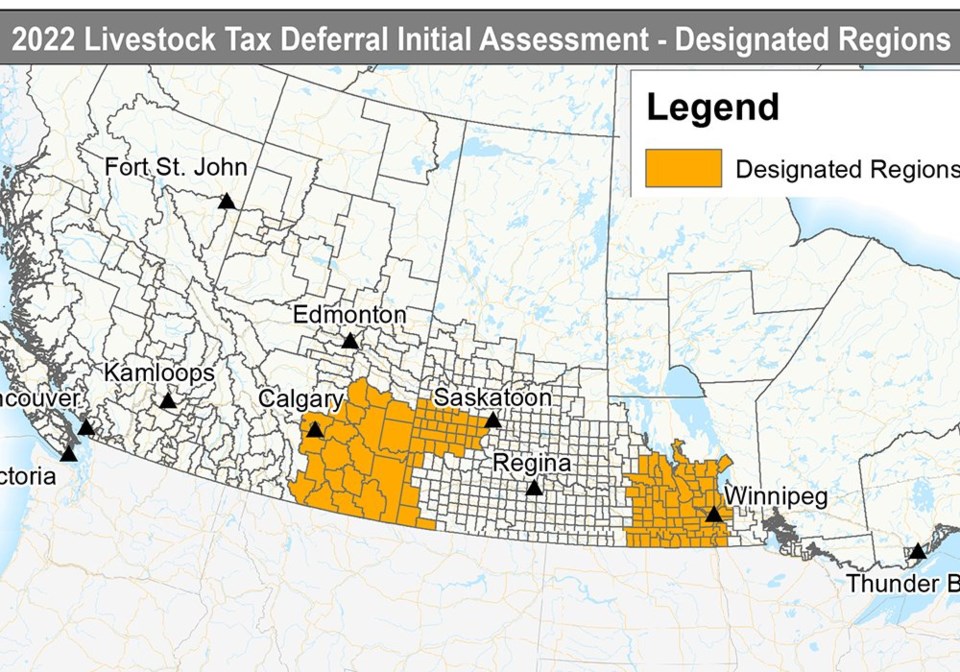

WESTERN PRODUCER — The federal agriculture minister has announced the initial list of designated regions in which livestock producers who have to downsize may qualify for tax deferrals.

Much of Manitoba, west-central Saskatchewan and southeast Alberta are included.

The provision applies to producers who have had to sell at least 15 percent of their breeding herds because of drought or floods. They can defer part of their income from those sales until the next tax year. Purchasing replacement animals can at least partly offset the tax costs.

The Saskatchewan Stock Growers Association said the deferral is a positive step for those who need it but it doesn’t go far enough.

President Garner Deobald said he’d like more information on how the areas were chosen.

“There are definitely areas outside those regions that are affected,” he said.

Specifically, few rural municipalities in the southwest were included. The areas north of Swift Current up to Rosetown and Biggar are extremely dry and livestock feed is scarce, he said.

Further south in the Glentworth and McCord area, there are farms that received less than 100 millimetres of rain and others with nearly 300 mm.

The government says regions were identified by weather, climate and production data in consultation with the industry and provinces. Criteria includes forage shortfalls of 50 percent or more.

“I think in this case they were probably using some old data,” Deobald said, adding he has heard from producers who have received payouts on their forage rainfall insurance but their municipalities are not designated.

More regions may be added later.

The Agricultural Producers Association of Saskatchewan called for the tax deferral in early June, saying pastures hadn’t recovered from last year’s drought and producers would be unable to sustain their herds without grass.

Deobald said there will be significant herd reductions in some areas this fall. Some producers have already culled hard through the summer as feed and forage supplies remain short.

“Markets are a lot stronger this year than a year ago,” he added, particularly for cows.

The SSGA and others have called for changes to the tax deferral program. Deobald said it would help if the deferral was available for a longer period, say five years. This would allow producers to buy back in when they are in a better financial position and market conditions are favourable.

Minister Marie-Claude Bibeau said that enhanced business risk management programs are also available to help producers but Deobald said they don’t always help when there are back-to-back bad years.

Livestock producers have also asked for improved cost-sharing of premiums in their programs.

The SSGA is working with Saskatchewan farmers who irrigate to encourage grain farmers to drop straw again this fall.

“There definitely has been some uptake,” said Deobald.

However, cattle producers are also encountering some reluctance from grain farmers who say they want to keep all the straw they can on their land given the federal government’s plan to reduce emissions from fertilizer.

“It’s making grain producers want to make sure they’re not taking anything out of the land,” he said.

There is a change at Saskatchewan Crop Insurance. After last year, it doubled its low yield appraisal threshold values to ensure more livestock feed was available.

“SCIC understands that this year there are smaller localized areas where again livestock feed is impacted. For 2022, while not doubled, SCIC does have low yield appraisal thresholds,” said the organization in an email.

If the appraised yield falls below the established threshold, it can be reduced to zero, depending on information gathered during the inspection. The threshold level is set to reflect the approximate cost of harvesting a severely damaged crop, the corporation said.

Producers can cut their crop for feed at any time but should contact SCIC for a pre-harvest appraisal first. A claim is filed if the producer decides not to harvest but to use the crop for feed.

“To account for all production, an adjuster will inspect any acres put to an alternate use. The appraised value will be added to the total harvested production for that crop in the event of a claim,” it said.

Contact [email protected]