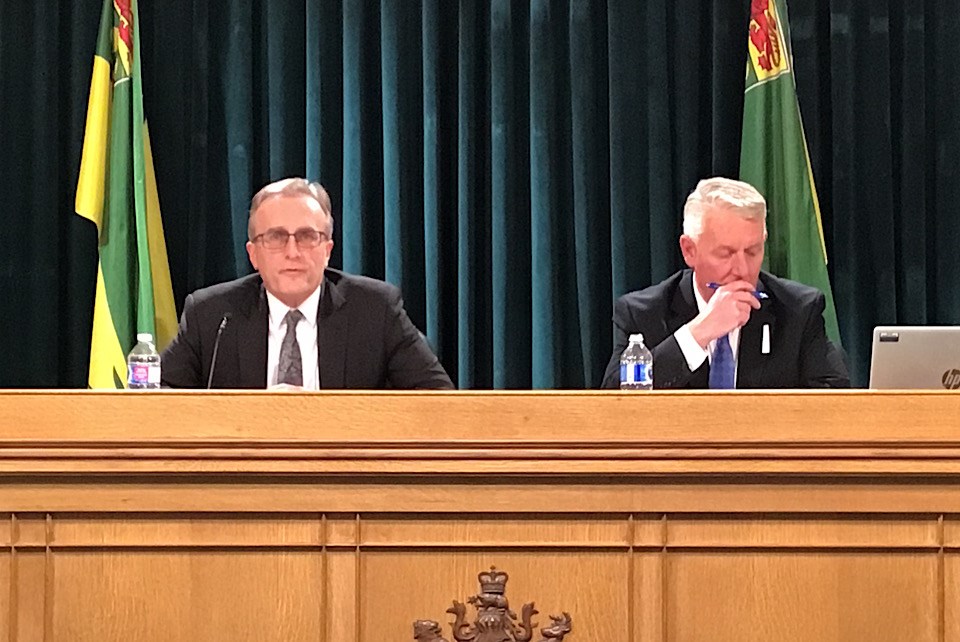

REGINA - Finance Minister Jim Reiter has presented the midyear report on Saskatchewan’s finances at the Legislature Thursday, and it was hardly a good news update.

The province is still in a deficit, projected at $743.5 million at midyear, ahead of what was projected in the spring budget by $470.4 million. But the deficit forecast is not driven by campaign promises from the recent election. Instead, crop insurance claims and expenses in areas like corrections and wildfire response had a particular impact.

Here are five takeaways from the province’s midyear update:

1. Weather woes negatively impacted budget

A big issue for the province was the dry conditions in many regions of the province which negatively impacted crop yields and quality, particularly with canola. The province is pointing to higher crop insurance claims with a forecast $385 million increase.

Officials are pointing to a particular bad stretch of hot conditions in July as a driver of those claims. Reiter stresses, though, that no additional government funds were required to fund crop insurance.

“For context, the last time additional government funds were required to cover crop insurance payments was in 2002. However, if additional government funds are required to fund crop insurance in future years, our government would step up as we believe it's absolutely essential to support Saskatchewan producers,” Reiter said.

There was also an increase of expenses in the category of Protection of Persons and Property by $128 million, due to operating pressures in correctional facilities and in wildfire response efforts particularly early on in the year.

Health spending also went up $100 million, mostly to address service and volume pressures across the system including more hiring.

2. Total revenue is up from budget, but so are expenses

Total revenue is up from budget by $275.1 million, for a 1.4 per cent increase from budget. It is up $183.2 million from the first quarter.

The largest areas of revenue growth are in the “other own source” and “taxation revenue” themes. Other own source includes such things as insurance income, investiment income, fees and miscellaneous income, and is slated to go up $235.5 million from budget according to the province. Taxation is also forecast to go up by $133 due mainly to a rise in corporate income taxes.

3. Expenses are up, as is gross debt, from the spring budget

On the other hand, total expenses outpaced the revenue increase, with expenses up by $745.5 million from budget and up $572.9 million from the first quarter.

Total gross debt is forecast at $35.2 billion, up $388.5 million from budget but a $12.3 million drop from the first quarter. The province is attributing this number as “entirely attributable” to the “self-supported” or Crown sector as reported in the first quarter.

4. Overall economic indicators still positive

The province’s economy is still performing well, with strong population and employment growth as well as the second fastest growing economy in the country in 2023, with a 2.3 per cent growth in real GDP. The net debt to GDP is expected to be 13.9 per cent, second lowest among Canadian provinces.

“Despite challenges, our fiscal picture is solid,” Reiter said. “More people than ever are living and working in Saskatchewan and our economy continues to grow.”

Reiter was asked about the potential impact of the new administration of President-elect Donald Trump not just with the 25 per cent tariff plans but also his plans to increase oil production — something that might impact resource revenues to Saskatchewan.

“On the oil and gas side, potentially, if they're doing more drilling, I mean, sort of the initial reaction would be that could put the price of oil lower. But on the other hand, there's also a lot of talk about Keystone being revisited or some version of it, which would certainly help our producers in the price,” Reiter said.

“So there are so many unknown variables right now that the best we can do is just try to stay on top of them. Things are changing by, not just by the day right now, but by the minute as far as trade with the US. So we'll have to stay on top of it and see how it turns out.”

5. Despite deficit, no impact on proposed affordability measures

When asked about whether the government would be able to keep its income tax cut promises made during the campaign, Reiter replied “yeah, absolutely.”

“We're committed to our platform and we made those promises. We're going to keep them.”

The indication from officials is there will be a lag time before the costs of those items in their affordability legislation will be reflected in the budget. A number of the programs require cooperation with the Canada Revenue Agency because they are based on a person's income tax filing, and so those would come in 2026 based on the 2025 filing year.

Overall, Reiter did not seem especially troubled by the numbers he presented Thursday.

“This isn't out of the realm of ordinary,” Reiter said. “You'll see, again, you'll see last year, you saw deficit anticipated through and then for other reasons, then there's a surplus, right? So you're going to see some fluctuations, you're going to see some quarters in some years with increases, decreases. To me, what's more important is trends and where we're going overall.”