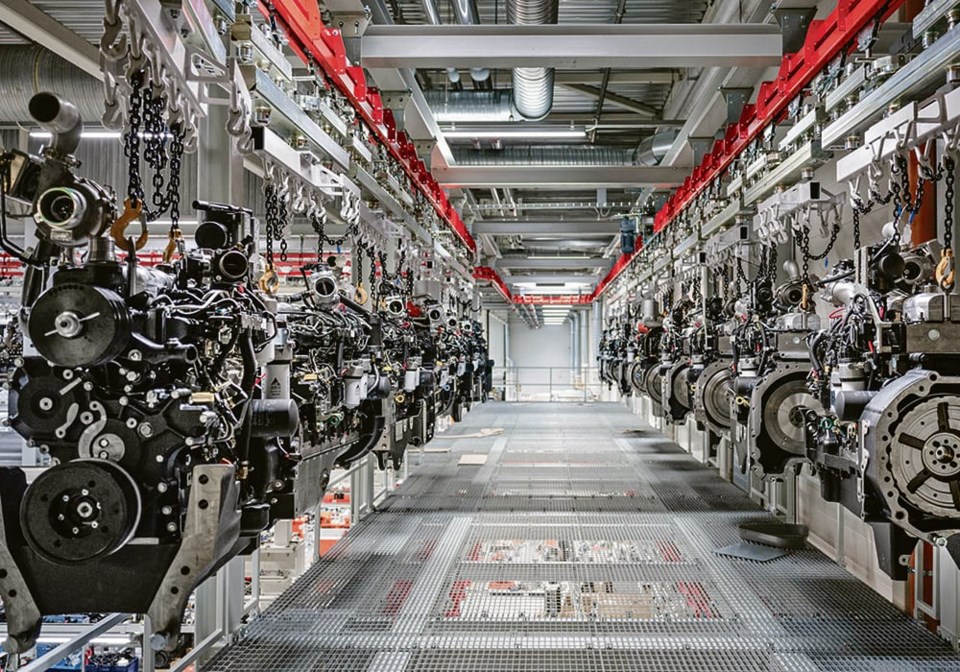

WESTERN PRODUCER — Any producer who purchased, or tried to purchase, new equipment over the past couple of years, as COVID raged, likely had to wait an unusually long time to take delivery, due to supply chain disruptions.

Along with inflating wait times for delivery, the disruption pushed retail prices through the roof due to record high ocean freight rates and production costs.

Even though COVID restrictions have ended and the world is getting back to normal, manufacturers are still feeling the effects of supply chain bottlenecks. In a July live interview with Yahoo Finance, CEO Eric Hansotia explained how his company is faring.

“On the supply side it’s gotten way better,” he said. “A year ago, we were having seven or eight issues per machine. Now, we’re down to one or so. Our rescheduling of assembly line issues is cut in half. So, the volume of components coming in is way better.”

The cost of getting component parts to the receiving door has been reduced significantly as well.

Although problems have eased, they haven’t completely gone away. And strategies manufacturers adopted to cope with those supply chain problems over the past two years are still proving valuable in keeping up production levels.

“It’s still a challenge,” says Adam Reid, vice-president of sales and marketing at . “It’s still meetings every day to look at what’s coming, what’s here. What are we lacking? What do the next six months look like, or three months, three weeks? We’ve tried to address the challenges as much as we could.”

A change in cab procurement procedures has been a big help to keep lines moving at Versatile. Delays in getting cabs had been holding up production so the company changed its sourcing requirements.

“A major change that’s happened as a result of that (supply disruption) is we now finish the cabs in Winnipeg,” says Reid. “Our cabs were built in Watertown, Â鶹ÊÓƵ Dakota, and we were buying the completed cab from our supplier. Now we just buy what we call the glazed cabs.

“That’s the ROPS structure and the glass and we do the finishing in Winnipeg. We now have a line set up for that with smart tools. It’s been a learning curve for us. But if we don’t have a cab, we can’t put a tractor on the line.

“So, if our supplier didn’t have, say a radio as an example, they wouldn’t ship us that cab, which means we can’t put a tractor on the line. Now we have control of that part of the supply chain. If we have a cab that’s incomplete, we can still put that tractor on the line and finish it and put that piece (in the cab) when it comes.”

At grain handling equipment manufacturer , supply disruptions have changed procurement procedures.

“That’s been an issue over the last couple of years,” says Derek Johnson, regional sales director at AGI. “Whether its supply products we’re buying from other countries or its steel itself, we’re buying in advance, well in advance. What that does is allow us to stay ahead of the curve.”

According to Hansotia, the large price retail increases of the past two years aren’t likely to continue into 2024, but producers shouldn’t look for price reductions either. Increases are likely, but at rates more typical of normal years.

“We’ve put a lot of price into the market over the last several years,” he says. “We expect that to stick and we expect to put a little more into the market, but not at the same high rates as last year.

“And that just goes along with the fact that general inflation is coming down. So we still see pricing power, but it will be more like trending toward normal historically than what we’ve had over the last couple of years.”

You can no longer count on social media to deliver important news to you. Keep your news a touch away by bookmarking SASKTODAY.ca's homepage at this link.

Here's why you should bookmark your favourites.

Subscribe to SASKTODAY.ca newsletter to get our daily news to your inbox.