After hearing numerous “horror” stories regarding the difficulties in dealing with insurance companies, a Sturgis woman now finds herself heading a new non-profit organization dedicated to lobbying for better regulation of the insurance industry.

Having experienced a couple of unpleasant interactions, Linda Greba recently described them on the social media site Facebook and was amazed to suddenly have more than a 150 Saskatchewan insurance holders reply to her with very similar “horror” stories. During discussions with these people, about 20 were willing to do their part to support the creation of a lobbying organization.

Greba noted that virtually all those contacted were in favour of the lobbying effort, but there was fear expressed that individuals participating in this exercise may face retaliation from insurance companies.

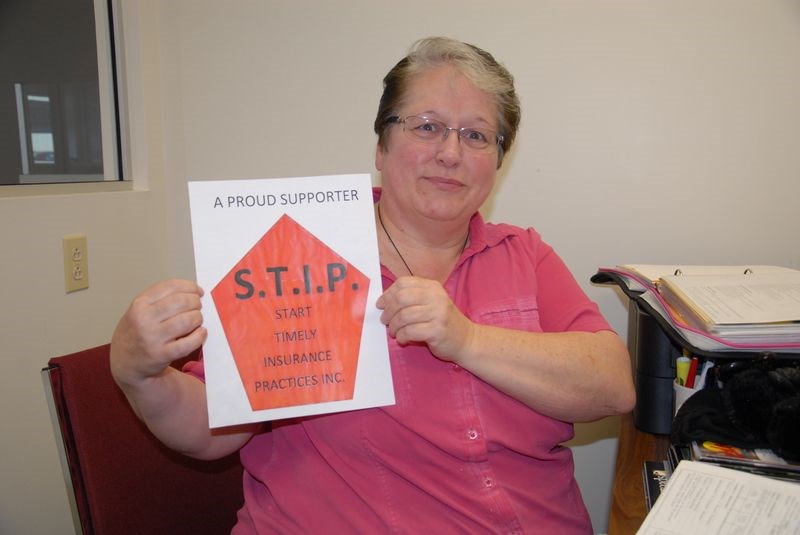

On January 12, an organizational meeting was held in Sturgis during which Greba was elected president and the official spokesperson from the organization called STIP, an acronym for Start Timely Insurance Practices Inc.

The goal is for the provincial government to create new regulations for the insurance industry to protect consumers, she said. To accomplish that requires a growing membership to be represented through the lobbying effort. STIP needs to create public awareness and that requires supporters to sign up. Donations are needed to keep the organization feasible.

Public awareness will be achieved through articles in newspapers and stories done by other forms of media, Greba said. Another means of growing public awareness is by printing posters and distributing them across the province. Everyone is being asked to prominently display the posters.

Because it is only the government that can pass the legislation to bring in the change of regulations, the upcoming provincial election has special significance, she said. The goal is to have packets of information about the STIP movement reach every candidate. A circulating petition will be used to demonstrate the number of voters supporting this cause.

STIP’s mission statement says its goal is to “improve building, property and vehicle insurance providers’ responsibility and practices in relation to all clients through all stages of interaction with insurance companies.”

The petition states that: “As we have no choice but to insure our homes, property and vehicles, I am seeking your support in telling your government officials to champion the cause for change to insurance practices and the laws governing the perceived credibility and accountability of insurance companies, adjusters and brokers. These are areas where improvement is a must.”

“It is a new age where a new way of viewing and handling current insurance practices is a must,” Greba said.

The petition describes eight areas in which improvement is a must.

More training is needed for brokers so they are able to give each policy holder clear, easily understood information with which to make informed choices.

Information packages and policies that are easy to understand need to be provided at all times to every claimant, including inspection reports, so that the policy holder can easily understand the insurance coverage, what exclusions there are, what to do when a claim situation arises and the broker’s responsibility in that claim process.

Packages for claim situations, which include expense vouchers for such items as living accommodations, belongings and meals, must immediately be given to all claimants.

Payment of vouchers must be made to the provider of services within 30 days of the claimant presenting the voucher.

The time frame must be improved, with penalties to insurance companies when claims are not handled within the time frame, for handling repairs, construction or reconstruction of the claimant’s property, residence or replacement of belongings.

A regulatory body is necessary for situations where safety is an issue for those inspecting or working on compromised premises. For those inhabiting compromised premises, a body is needed before, during and after a claim situation arises, so that a concerned claimant can submit questions and concerns and receive written reports that ensure safety issues have been addressed (three to five days) before further attention to work or inhabitation resumes.

It is necessary for annual reports to be published by insurance companies with 60 days of the fiscal year end: showing the actual (not percentage) number of claims handled; amounts paid out; and full or partial payout. Improved monitoring on this process is needed to ensure reports are published and made available to the public.

The final area that needs to be addressed is for an organization to be formed to represent the client in every step of the process.

To illustrate how big this issue becomes, Greba said that it is estimated that about one million people in Saskatchewan purchase plates and insurance for their vehicles. The average person spends about $300 per month for their insurance packages. This nets the insurance companies about $3 million per month.

“We are the individuals that make their (representatives of insurance companies) income possible and yet we have the least input,” she said. “It is time for a change. Let us join and become a voice that makes that change happen. Become a voice that is counted.”

Greba said she felt very alone in her dealings with insurance companies. It helped somewhat knowing that other people were having similar problems. From there, a lot of research resulted in learning some interesting facts about the insurance industry. She even discovered that there are many inconsistencies in what people are being told when dealing with different departments in the insurance industry.

An example is that Saskatchewan Government Insurance (SGI) is not required to follow the same regulations as other insurance providers, mainly because it is a Crown corporation.

Greba said she sent a letter expressing concerns to Don McMorris, the provincial minister responsible for SGI. What she received back was essentially a “brush off” letter.

During her research to get to the point of organizing STIP, Greba said she heard about many, many insurance claim nightmares. However, there was a common thread. That was that the insurance companies seemed to use intimidation practices as a control mechanism. When the company does not share information, it leaves the claimant feeling helpless or even stupid.

Greba’s story

Greba said her insurance horror story began during the winter of 2014-15. A storm had removed most of the shingles off her home (a former theatre and bowling alley) in Sturgis. When making a claim, she found out that another person had been listed as a co-payee. When neither the broker or the insurance company agreed to remove the person’s name, Greba enlisted the services of a lawyer.

She took the matter to the Fair Practices Office and when no help was given, she took the matter to the Insurance Council of Saskatchewan, and, as of yet, has received no response.

It was about five months ago that a vehicle was driven through the front of her building and it was exactly during a period in which she had a potential buyer for the building. Greba was worried about the structural viability of the building so she asked the adjuster to have an engineer assess it before the damages were covered up. The adjuster said he thought there was no problem with the structural integrity but he refused to put that in writing. It took a full five months before she received an engineer’s report stating that the building was structurally sound.

Combining her situation with the stories told by other insurance claimants, Greba noted there were many, many cases where those insurance practices fell short of what the policy holder needed and often believed they were covered. In these cases the insurance company failed to fulfill the policy holder’s belief “of what was contained the insurance contract.”